Institutions Bet Against Bitcoin Price As Fundamentals Improve

- Editor @ Capfolio

- Nov 20, 2019

- 5 min read

In Capfolio’s latest analysis, we update our position on the state of institutional investors in the Bitcoin market. Recent reports have made it clear that institutions are betting on price moving downward. We see the most likely scenario for bitcoin price being a decline to an area of buyer liquidity.

Quick take:

• Bitcoin price and the sentiment of investors took a hit over trading last week

• With bitcoin price trading below its 200 DMA and the OBV trending downwards, we anticipate further bitcoin price declines in the near-term future.

• Recent reports have illustrated that institutional investors are betting on Bitcoin price moving to the downside

In last week’s analysis, we noted that bitcoin price was entering a vulnerable position despite significant increases being recorded before the analysis was carried out. Two main factors played into our decision to anticipate considerable price declines:

• Price trading below the 200 daily simple moving average (200 DMA)

• On-balance volume (OBV) indicator trending downwards

Our dim outlook for near-term price action proved to be accurate for last week’s price action with bitcoin price declining roughly 6% for the week of trading. Last week’s developments have also hurt investor sentiment.

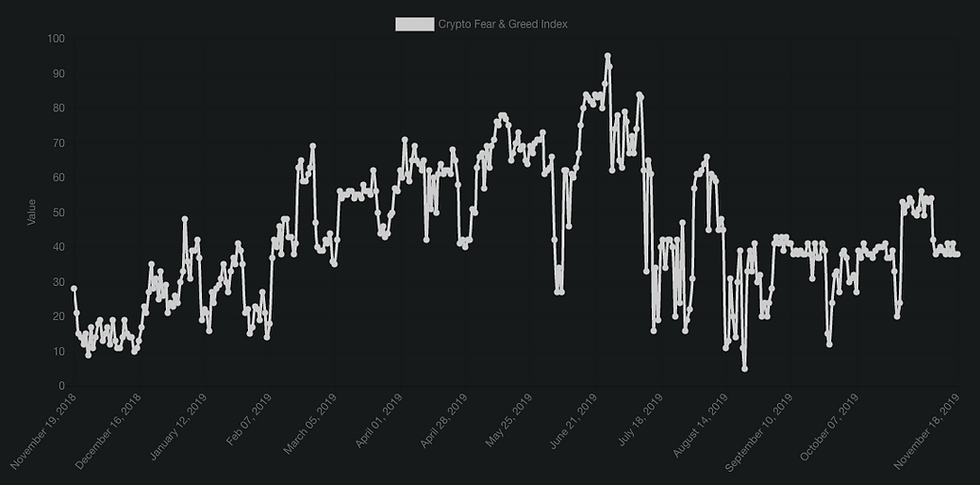

The Crypto Greed and Fear Index, a sentiment indicator which takes into account social media data, volatility levels, and survey data has shown a marked decline over the past week. Over the past week, the Crypto Greed and Fear Index has moved from fluctuating around 53 to moving in a range of 38 to 41.

But the main thing that bitcoin traders want to know is how the price is shaping up for the coming weeks. In this week’s analysis, we breakdown the latest developments and the implications for price action. Chief among these are updates on the state of institutional investors in the Bitcoin market, technical analysis developments, and developments in the technology underlying the fundamentals of Bitcoin.

Bitcoin Technical Analysis Developments

The main drivers behind our pessimistic short-term price outlook last week was price trading below the 200 DMA and the OBV trending downwards. Neither of these factors has changed.

The past two times OBV trended downwards preceded significant bitcoin price drops. While this does not guarantee that a significant bitcoin price drop will follow on this occasion, it is certainly worth monitoring.

In the event of a sharp movement to the downside, $7,736 is a noteworthy area to consider accumulating. Bitcoin price has found strong support here in recent trading and this area is also in the region of the most liquid price action in 2019 as indicated by the VPVR graphed along the righthand side of the above chart.

There has been a lot of anticipation among Bitcoin market participants that bitcoin price will move significantly to the upside ahead of or shortly afterthe 2020 halving. This is evident from the persistent discussion of the bitcoin halving taking place on social media.

It is simply not guaranteed that bitcoin price will move significantly to the upside ahead of or after the 2020 halving. However, it would be prudent to monitor bitcoin market developments which may signal to bitcoin investors that this is a good entry time.

We will be closely monitoring the 50 and 100 weekly simple moving average (WMA) over the coming weeks and months. We are aware that an upside crossover may signal to large bitcoin investors that this is a good entry price point ahead of the halving.

If bitcoin price sells-off below the $7,736 level marked on the Bitcoin chart, a critical point to monitor is the 100 WMA. If bitcoin price closes below the 100 WMA on the weekly chart, the medium-term uptrend we have been undergoing since April will likely reverse and we may experience a return to December 2018 bitcoin price lows.

The State of Bitcoin Institutional Investment

In our previous analyses, we have emphasized theimportance of assessing what institutional investors are doing in the Bitcoin markets. The direction which institutional investors are betting has a huge impact on the market and is a key factor to take into consideration for bitcoin price outlook.

We recently stated that it looks like institutions are accumulating due to a spike in the number of addresses holding greater than 1,000 Bitcoin as illustrated below. While this is the case, recent data has highlighted that institutional investors are decisively bearish while professional traders have recently turned bullish.

The Commitment of Traders (COT) report released by the CFTC every Friday at 3 pm CT partitions traders into institutional investors, professional traders, and retail traders. The report analyses the positions of these traders in both the CME Bitcoin derivatives market to determine their outlook *.

While professional traders recently entered into positive territory for their outlooks in the bitcoin derivatives market, institutional are deep in negative territory. This would lead us to expect more significant price drops in bitcoin’s short-term future.

We assign a probability of roughly 60% to bitcoin price dropping from here and finding sufficient buying pressure close to the $7,800 price level or close to the 100 WMA. We assign roughly 30% probability to bitcoin price dropping below these levels and sharply selling off into territory that we can’t anticipate. The final 10% probability is the unlikely event that bitcoin price will undergo a sharp increase from this point and never again return to test the $7,800 price level.

Long-Term Price Outlook Strong as Bitcoin Fundamentals Improve

Several positive Bitcoin fundamental developments took place during the week. Braiins, the company behind Bitcoin mining pool Slush Pool, released the source code for their much-anticipated mining protocol Stratum v2.

Mining centralization is a highly debated risk factor in the Bitcoin world and this mining protocol serves to make communication between mining pools and miners more secure while also allowing miners to make their own decisions when it comes to appending blocks and choosing transactions. The development of the Stratum v2 mining protocol is an all-round win for Bitcoin as whatever adoption it receives will only serve to make Bitcoin more secure.

Stratum v2 was not the only important development during the week. Jamal James announced Polar, an open-source desktop application that will enable developers building on top of the Lightning Network to easily test ideas.

The Lightning Network is a second-layer solution aimed at improving Bitcoin’s scalability. Improving tools that allows developers to build on top of the Lightningnetwork is a step towards Bitcoin becoming an all-round more valuable network for stakeholders.

Such fundamental developments typically do not have a direct impact on price. Firstly, the majority of the bitcoin market does not factor such fundamental developments into their decision-making, and secondly, these fundamental developments could be just as quickly reversed with a negative news development such as a bug being introduced, a successful attack or a government outlawing bitcoin.

Nonetheless, such developments only strengthen and reinforce our positive long-term outlook for Bitcoin. Positive fundamental developments eventually lead to increased utility for Bitcoin users which in turn will foster greater demand, which must ultimately manifest itself in a greater bitcoin price given its limited supply.

Bitcoin Technical Analysis Summary — Downside Price Movement in Store?

We updated our stance on how institutional Bitcoin investors are betting in light of recent CFTC COT reports. While professional traders are betting for upside movements, the bearish stance of institutions combined with how the bitcoin technical analysis is shaping up lead us to anticipate downward bitcoin price movements.

In the coming weeks, we foresee the most likely scenario for bitcoin price as a downside movement to an area of buyer liquidity. We anticipate a significant amount of buyer liquidity to come into Bitcoin around $7,800.

*Technical note — For the CFTC COT report, positions in both the CME futures and options bitcoin market are considered. The data shown illustrates the open interest in futures adjusted to account for trader’s positions in the options market. Long-call and short-put open interest are converted to long futures open interest after being adjusted for delta. 500 long-call option positions with a delta of 0.5 would add 250 to the futures open interest. Short-call or long-put options open interest are converted to short futures open interest after being adjusted for delta. 500 long-put options positions with a delta of 0.5 would subtract 250 from the futures open interest. This is why institutional investors can have a negative open interest figure.

Comments